Please note:

1. The sheet includes Working and Child Tax Credits and Child Benefit. It ignores out-of-work benefits (ESA, Income support etc) because those would be replaced £ for £ with the Citizen's Income, with separate top-ups for disability.

2. The PAYE calculator is a simplified method that comes to within a few pounds of the 'correct' figure according to HMRC tables. Neither figure is really 'correct' as they both assume earnings accrue absolutely evenly throughout the year.

3. The figures include the following stealth taxes:

- Employer's National Insurance Contributions, which depress wages by a similar amount.

- VAT calculated as 10% of household income (£95 billion VAT divided by £950 billion). It might be more accurate to calculate this as a 15% of earned income (i.e. £95 billion divided by £600 billion).

- Council Tax, TV licence fee, Stamp Duty Land Tax etc, which currently raise £52 billion. The total value of UK housing at present (2014) is approx. £5,800 billion. Some of these taxes are progressive and some regressive, but it averages out and each household's annualised lifetime tax bill approx. 0.9% of the value of the home they occupy.

4. The calculator applies to best to owner-occupiers who are unaffected by current rent levels.

As to "landlords passing on the tax to tenants", if we assume that landlords increase their rents by the amount of the tax, the saving to tenant households would be exactly the same. If rents were capped at current levels, then tenants would save considerably more.

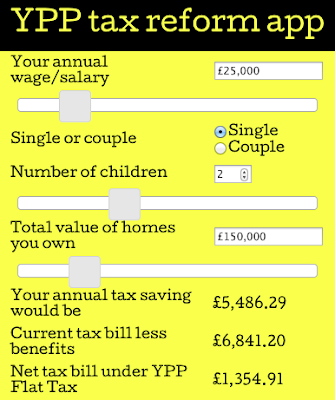

This is slightly confusing to me. Is the annual tax saving the amount by which a taxpayer would be bette off - or is it the net tax bill?

ReplyDeleteSaving = how much your tax has gone down i.e. how much you are better off

ReplyDeleteCurrent tax bill = what your tax bill is presently

Net tax bill under YPP flat tax = what it would be if we had the YPP flat LVT/flat income tax system.

I've inputted my figures, which implied that i'd be ok buying a house worth 600k on the logic that id have more take home pay, wouldn't this simply increase the property bubble further. Currently i'd struggle to secure a mortgage on 2 bed flat around 300k.

ReplyDeleteU, yes, it is a dynamic thing. Higher earners will more easily be able to buy more expensive homes; lower earners (i.e. Baby Boomers in semi-retirement) will be eased out of more expensive homes.

DeleteI assume that the two effects largely cancel out. Quite possibly they don't, but nobody is going to try full-on LVT overnight, you do it over five or ten or fifteen years and keep tweaking things to ensure there are more winners than losers at each stage.

Thanks Mark, I'm writing/researching on LVT for my dissertation @UCL. Currently in the Lit review stage. I was wondering if you'd be open to a conversation on the topic in a few weeks time?

DeleteDH, sure send me an email gmwadsworth@gmail.com

DeleteOh no, all my dreams and hopes are gone. Can the communism save us? 먹튀검증

ReplyDeleteAn interesting discussion may be worth comment. I do believe that you ought to write much more about this topic, it might certainly be a taboo subject but usually folks are too few to communicate on such topics. Yet another. Cheers 먹튀검증

ReplyDeletevat solution

ReplyDeleteVAT is essentially a consumption tax levied at every stage of the supply chain (added on the value added to goods and services) – from raw materials to the end product. It importantly serves as a source of revenue for governments.

Encontré una herramienta para calcular Tarifa por Hora y me resultó muy práctica porque pude medir de manera precisa cuánto tiempo dedico a cada actividad sin complicaciones.

ReplyDelete